What Happens If You Die Without a Will as an Unmarried Partner

What Happens If You Do Not Have a Will? The Truth For Unmarried Couples

If you do not have a will, the law writes one for you.

If your plan is “my partner can fight my family for the house”, then crack on.

If not, it might be time to get this sorted.

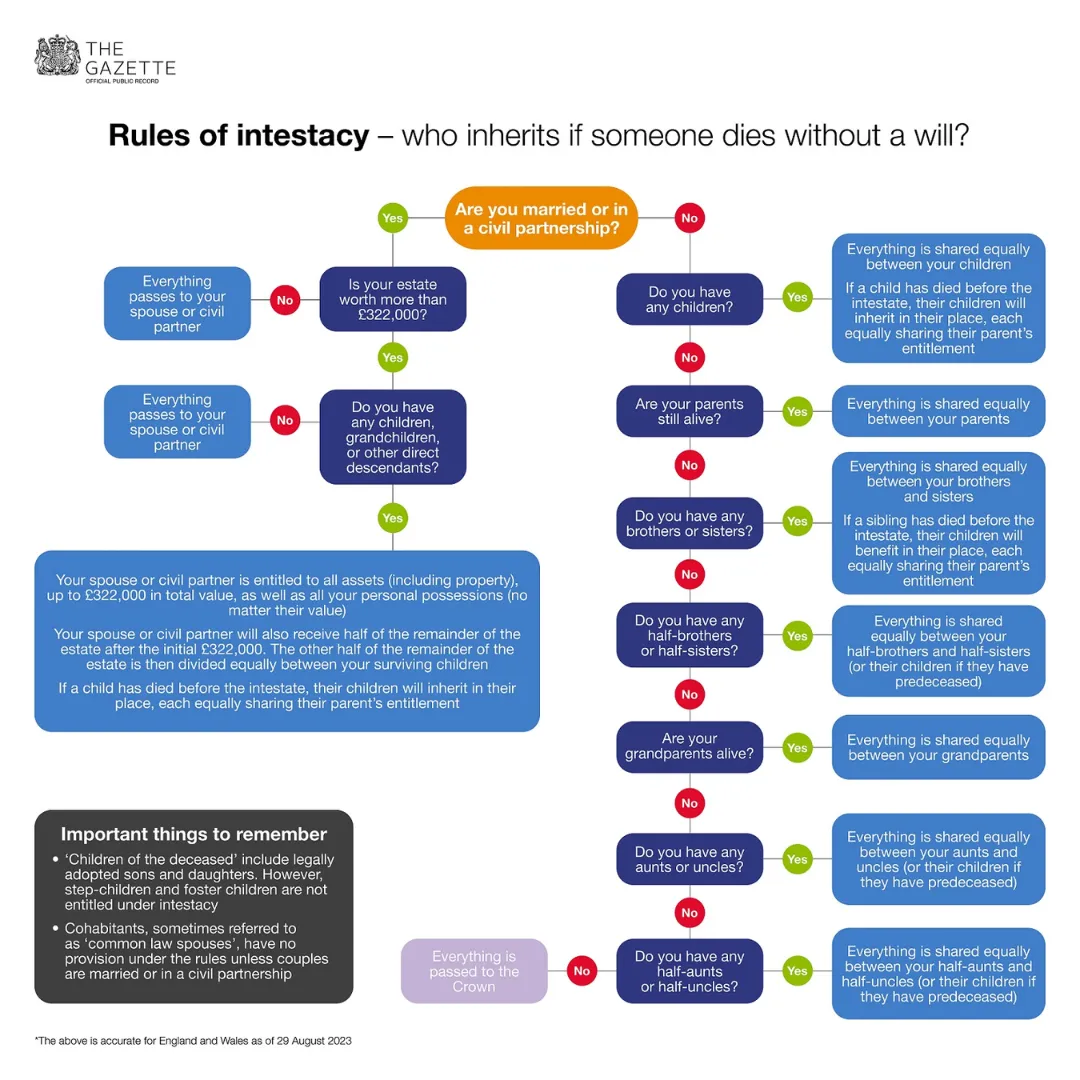

Take a look at the intestacy ladder in the image below. Just check you are comfortable with those people getting everything.

If you are not married, your partner is nowhere on that list. Not even close.

This catches people out all the time. Unmarried couples who have built a life together often assume “common law partner” is a real legal status. It is not. It does not exist in England and Wales, and intestacy rules do not bend for love, shared bills or the length of your relationship.

So let us break down exactly what happens, why so many people get caught out, and what steps you can take to protect the person you care about most.

The Rules of Intestacy: What Actually Happens Without a Will

Intestacy rules follow a strict hierarchy. There is no flexibility and no consideration of someone’s personal wishes. The law simply follows its own system, step by step, until it finds the first qualifying relative.

The order looks like this:

Spouse or civil partner

Children

Grandchildren or great-grandchildren

Parents

Siblings

Nieces and nephews

Half-siblings

Grandparents

Aunts and uncles

Cousins

If absolutely no blood relatives can be found, everything goes to the Crown.

There is no category called “partner”.

There is no category called “lived together for years”.

There is no special box for “we have shared everything since 2013”.

Unless you are married or in a civil partnership, the law considers you unrelated.

This is why unmarried couples are the most vulnerable group when someone dies without a will.

Case Study: Laura and Michael

Laura, aged 48, lived with her partner Michael, 49, in Leicestershire for over ten years. They were not married, but their life worked like any married household. They shared bills, routines, responsibilities and future plans. They worked hard, raised children from previous relationships together, and considered the home theirs jointly.

The one thing they had never sorted was the paperwork.

The house was registered in Michael’s name. It had just never felt urgent.

Then Michael died suddenly after a short illness.

What happened next

Laura was already grieving. What followed made everything dramatically worse.

• Because they were not married, Laura had no legal right to inherit anything.

• Under intestacy rules, everything passed to Michael’s adult son.

• The son, shocked and overwhelmed, decided the house needed to be sold quickly.

• Laura had to begin legal proceedings simply to stay in the home she had lived in for more than ten years.

• She had to gather bank statements, records of contributions, messages, and anything that proved she had been a financial partner.

• She went from planning a future to defending the roof over her head.

Michael had always intended for Laura to be looked after. They had said it to friends. They had said it to each other. But intentions mean nothing in law.

What a simple will would have done

Michael could have:

• Given Laura the right to stay in the home for life

• Left money or personal items directly to her

• Protected his son’s inheritance without forcing a house sale

• Avoided legal costs, stress and emotional strain

A thirty minute appointment would have rewritten the entire outcome.

Why This Happens More Than People Realise

Unmarried couples are far more common than ever. Plenty of people choose partnership over marriage for personal, financial or practical reasons. Many assume a “common law marriage” exists and gives them some rights.

It does not.

I see it all the time. People assume:

• “If anything happens, my partner will be supported.”

• “Everyone knows what we want.”

• “The family will be fair.”

• “We have lived together for years, so that must count for something.”

• “We will get round to sorting the will soon.”

And then life happens.

Accidents. Illness. Unexpected loss.

The surviving partner suddenly discovers that everything they built together is legally classed as one person’s estate, not a shared life.

This is why intestacy hits unmarried couples so hard. The law simply was not built to recognise modern relationships.

Children Complicate Matters Even More

If there are children involved, the situation becomes even tougher.

If the house is in one partner’s name and there is no will:

• Their children inherit everything

• The surviving partner can be forced out of the home

• Children cannot access their inheritance until 18

• A court may need to become involved in managing finances

• The surviving partner can end up financially stranded

There has been partners unable to access funds needed to raise the children they share. There has been people lose homes they have contributed to for decades. None of this would have happened if a will had been put in place.

What About Joint Homes?

If the property is owned as joint tenants, the surviving partner will inherit the property automatically.

If the property is owned as tenants in common, the deceased person’s share follows the intestacy rules.

Most people have no idea which one they are.

A will solves this too.

Why Unmarried Partners Are the Most At Risk

The law does not recognise commitment.

It recognises:

• Marriage

• Civil partnership

• Bloodline

That is it.

If you fall outside those, intestacy rules are not your friend.

And I will be honest. I used to be in this category myself. It was only after starting my wills business that I finally sorted my own affairs out. My partner is older than me, and if anything happened to him, I would not have been recognised under the law. That thought alone was enough to make me take my own advice.

This is why I speak so strongly about it now. I have seen the fallout first hand with clients, and I have imagined it for myself.

Do You Need a Will if You Are Unmarried? The Short Answer Is Yes

A will allows you to:

• Make sure your partner is protected

• Decide who inherits your home and savings

• Choose guardians for children under 18

• Avoid disputes and legal battles

• Name trustees and executors you trust

• Keep control of sentimental items

• Make things easier for the person left behind

It does not matter how simple or complex your situation is.

If you have a partner and no will, you are relying on luck.

If You Are In The Same Situation

Do not leave this hanging.

If you want to know exactly what would happen in your circumstances, send me a message.

I will talk you through it clearly and confidentially, and you will leave the conversation knowing where you stand and what needs to be done. No pressure, no jargon, just clarity.

A will is not long or difficult to sort, but the consequences of not having one can be life changing.